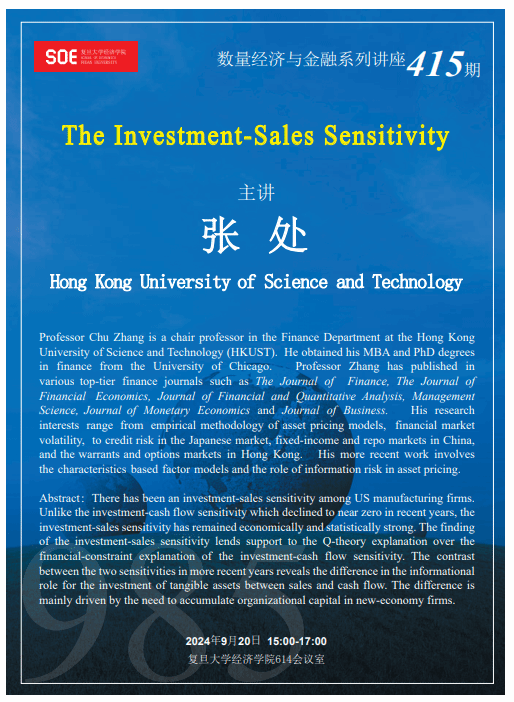

Paper Title:The Investment-Sales Sensitivity

Speaker:张处,Hong Kong University of Science and Technology (HKUST)

Professor Chu Zhang is a chair professor in the Finance Department at the Hong Kong University of Science and Technology (HKUST). He obtained his MBA and PhD degrees in finance from the University of Chicago. Professor Zhang has published in various top-tier finance journals such as The Journal of Finance, The Journal of Financial Economics, Journal of Financial and Quantitative Analysis, Management Science, Journal of Monetary Economics and Journal of Business. His research interests range from empirical methodology of asset pricing models, financial market volatility, to credit risk in the Japanese market, fixed-income and repo markets in China, and the warrants and options markets in Hong Kong. His more recent work involves the characteristics based factor models and the role of information risk in asset pricing.

Abstract:There has been an investment-sales sensitivity among US manufacturing firms. Unlike the investment-cash flow sensitivity which declined to near zero in recent years, the investment-sales sensitivity has remained economically and statistically strong. The finding of the investment-sales sensitivity lends support to the Q-theory explanation over the financial-constraint explanation of the investment-cash flow sensitivity. The contrast between the two sensitivities in more recent years reveals the difference in the informational role for the investment of tangible assets between sales and cash flow. The difference is mainly driven by the need to accumulate organizational capital in new-economy firms.

时间:2024年9月20日 15:30-17:00

地点:新葡萄8883官网amg614会议室

返回顶部

返回顶部